قم بإحالة صديق واربح تذاكر سحب اليانصيب!

قم بإحالة صديق إلى Zenstox ويمكنك الفوز بجوائز قيمة. كلما أحضرت المزيد من الأصدقاء، زادت فرصتك في الحصول على تذاكر أكثر! يحتاج صديقك فقط إلى إيداع مبلغ وتقديم جميع الوثائق اللازمة سوف تدخل المسابقة. هل لديك أحد الأصدقاء في البال؟

اكسب جوائز رائعة!

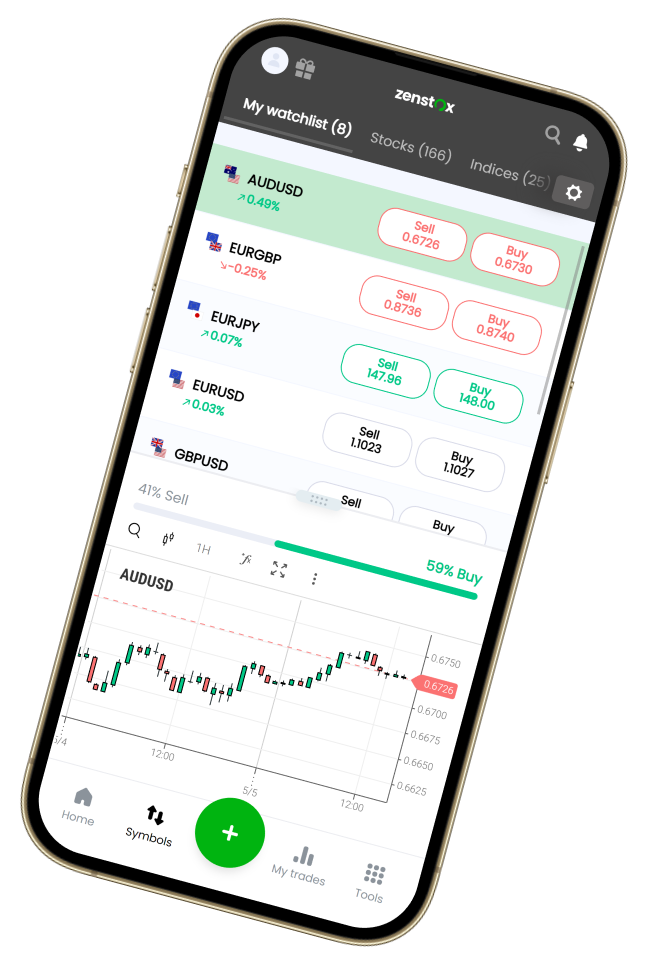

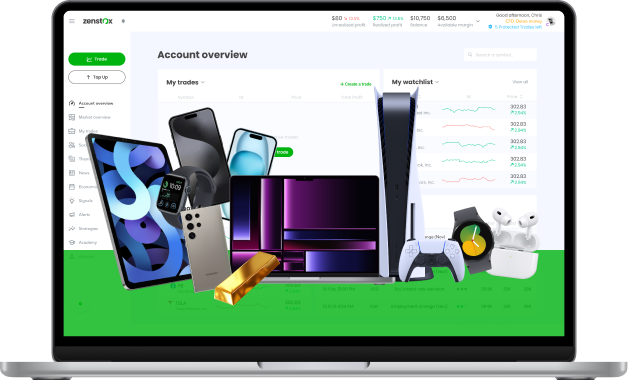

تداول قائمتنا المميزة من عقود الفروقات (CFD)

من أمازون إلى زووم، لدينا كل شيء! تحقق من قائمتنا الوفيرة من عقود الفروقات الممتازة على مختلف الرموز، بما في ذلك الفوركس، الأسهم، المؤشرات، السلع والعملات الرقمية.

تداول قائمتنا المميزة من عقود الفروقات (CFD)

من أمازون إلى زووم، لدينا كل شيء! تحقق من قائمتنا الوفيرة من عقود الفروقات الممتازة على مختلف الرموز، بما في ذلك الفوركس، الأسهم، المؤشرات، السلع والعملات الرقمية.

3 أسباب لماذا يجب أن تتداول مع Zenstox

*حسب نوع الحساب الخاص بك، سيتم حماية أول 5-15 مركزًا. يعني ذلك أن المال الذي تخسره في تلك المعاملات الأولية سيتم استرداده، ولكن بالمقابل، ستحتفظ بجميع أرباحك. كيف يبدو ذلك؟

Zenstox هو المكان الذي يمكنك من خلاله التداول في كل شيء من عقود الفروقات على الأسهم إلى عقود الفروقات على العملات الرقمية دون الحاجة لامتلاك الرموز الأساسية. في التداول عبر الإنترنت بعقود الفروقات، كل ما عليك فعله هو التنبؤ باتجاه السعر الصحيح واستغلال حركات السوق.

لقد وجدنا الطريقة المثالية لتحسين تجربة التداول من خلال توفير منصة مبتكرة، سواء عبر الويب أو على الهاتف المحمول، تلبي احتياجات كل تاجر بغض النظر عن خبرته في الاستثمار. اتخذ صفقات فورية بغض النظر عن مكان وجودك.

الأمان أولاً

طرق الإيداع والسحب سريعة وشفافة لجعل تجربة التداول سهلة ومريحة.

الموقع مؤمن بواسطة SSL للتأكد من أن البيانات المرسلة بينك وبين وسيط الوساطة خاصة.

أموالك محفوظة في حسابات مصرفية منفصلة في جميع الأوقات، لذلك هي آمنة من جانبنا.

Zenstox هو اسم تجاري مملوك ومشغل بواسطة VIE FINANCE SEY LTD، وهي شركة استثمار مرخصة بالكامل ومنظمة برقم الترخيص SD123.

الاعتماد على الدعم الافضل والمميز

Zenstox هذا الموقع يوفر لكل الهملاء افضل خدمةعملاء من حيث الخبره والمعرفه, لكل عميل لديه اسئله او اي معلومه غير مفهومه في الموقع , فمندوبي خدمة العملاء موجودين للمساعده واعطاء المعلومات لكل عميل . موجود مندوبي خبره يتحدون بعدة لغات لكي تكون التجربهيوصلون المعلومات لكل عميل لدينا .

ثقة العميل من اولوياتنا

اسمنا يعني كل شيء بالنسبة لنا. ولهذا السبب، فإننا نأخذ ثقتك على محمل الجد. نحن نقاتل من أجل ذلك.

نحن نسعى جاهدين لحل كل مشكلة قد تواجهك، وإذا لم تكن راضيًا عن شيء ما، فنحن دائمًا هنا لسماع صوتك وإيجاد حل. معنا يمكنك العثور على أكثر من 300 مجال مقابل الفروقات للاستثمار فيها، بالإضافة إلى فرص تداول لا تعد ولا تحصى. لذا لا تتردد في الاتصال بنا.

ضمان الرضا

اسمنا يعني لنا كل شيء. لهذا السبب، نحن لا نأخذ ثقتك على محمل الجد. نحن نكافح من أجلها!

نحن لا نقدم فقط تكاليف منخفضة للتأكد من أن لديك المزيد للاستثمار، بل نكون ملتزمين تمامًا بك – العميل. نحن نسعى لحل كل مشكلة قد تواجهها، وإذا لم تكن راضيًا عن شيء، فنحن هنا دائمًا لسماعك وإيجاد حلاً. معنا يمكنك العثور على أكثر من 300 عقد فروقات للاستثمار، بل وفرص تداول لا تحصى. لذا، لا تتردد في الاتصال بنا.